At TOKERO, our mission is to make crypto accessible to everyone in a simple, fast and safe way.

Introduction:

In 2009, an anonymous person or group known as Satoshi Nakamoto introduced the world to Bitcoin, a groundbreaking decentralized digital currency that aimed to revolutionize the financial landscape. Since then, Bitcoin has grown into a global phenomenon, capturing the imagination of investors, tech enthusiasts, and mainstream audiences alike.

At its core, Bitcoin is a digital currency that operates on a decentralized peer-to-peer network, utilizing blockchain technology. Unlike traditional fiat currencies that are controlled and regulated by central banks and governments, Bitcoin is not issued or governed by any single entity. Instead, its creation and transactions are managed collectively by a distributed network of participants, referred to as miners and nodes.

Technology:

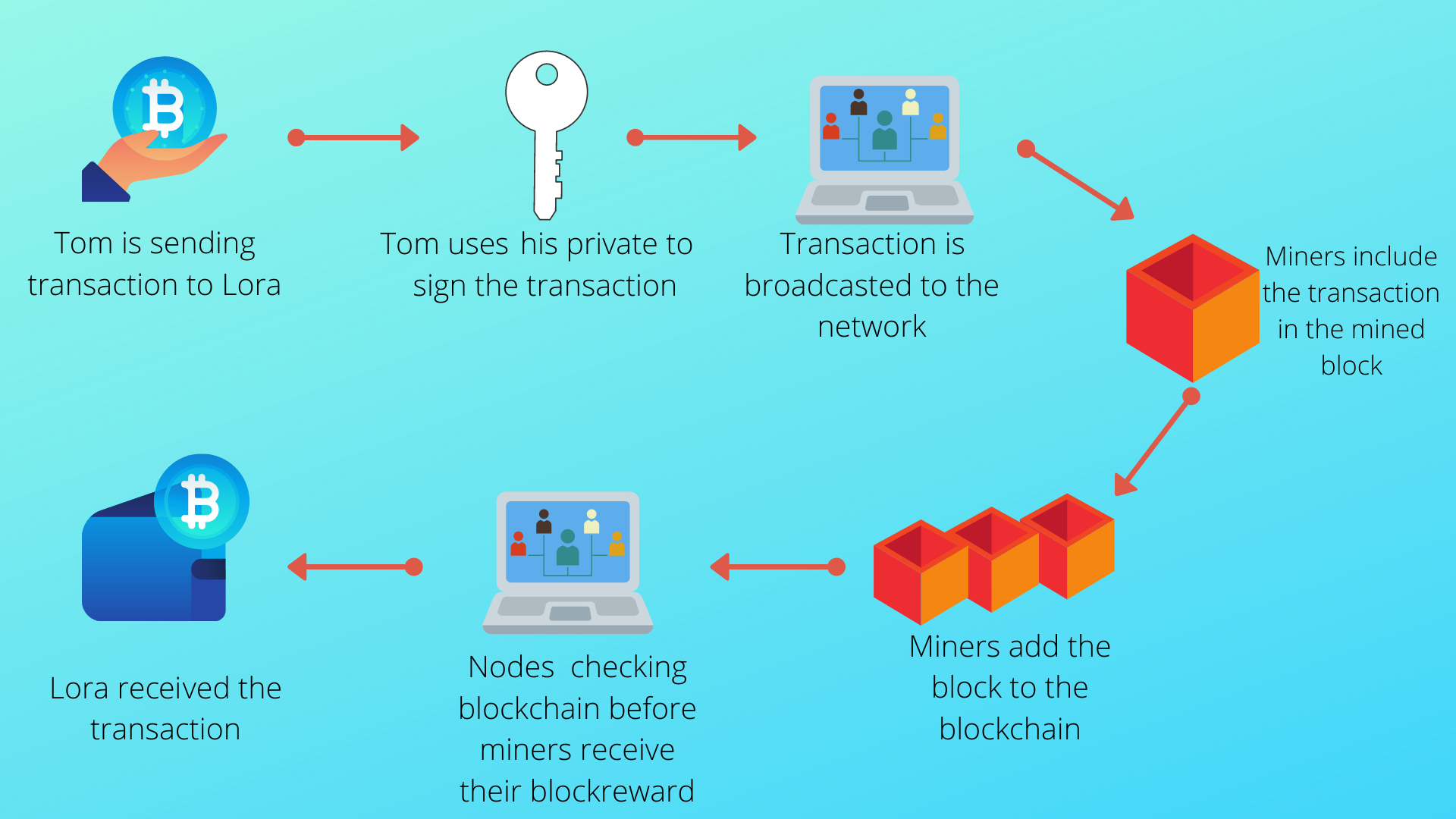

Central to Bitcoin's success is its underlying blockchain technology. A blockchain is a public ledger that records all transactions made with Bitcoin. It consists of a chain of blocks, each containing a set of transactions, and is secured by complex cryptographic algorithms. This distributed nature ensures transparency and immutability, as tampering with a single block would require altering all subsequent blocks on the chain.

One of the most significant aspects of Bitcoin is its fixed supply. Satoshi Nakamoto designed Bitcoin to have a maximum supply of 21 million coins, making it a deflationary asset. This scarcity is in stark contrast to fiat currencies, which can be printed at will by central authorities, potentially leading to inflation.

The process of creating new bitcoins and validating transactions is known as mining. Miners use powerful computers to solve complex mathematical puzzles, and the first one to solve the puzzle gets the right to add a new block to the blockchain and is rewarded with newly minted bitcoins. This incentive system ensures the security and integrity of the network and motivates miners to contribute their computational power.

Bitcoin's decentralized nature eliminates the need for a trusted intermediary, such as a bank or payment processor. Transactions occur directly between peers, reducing the risk of censorship, fraud, and third-party control. This feature has made Bitcoin an attractive option for individuals and businesses seeking financial sovereignty and privacy.

Bitcoin's price volatility has been a point of discussion and concern for both supporters and critics. While it has experienced significant price fluctuations, it has also demonstrated an impressive ability to recover and grow. Many proponents see Bitcoin as a store of value akin to digital gold, especially in times of economic uncertainty and geopolitical instability.

A new financial system:

Since its inception, Bitcoin has disrupted the traditional financial industry in several ways:

- Financial Inclusion → Bitcoin has enabled access to financial services for the unbanked and underbanked populations worldwide, allowing them to participate in the global economy without the need for a traditional bank account.

- Remittances → Bitcoin's low transaction fees and borderless nature have made it a viable alternative for international remittances, providing faster and cheaper options for sending money across borders.

- Investment Asset → Institutional and retail investors have recognized Bitcoin's potential as a hedge against inflation and economic downturns, leading to its inclusion in investment portfolios alongside traditional assets.

- Financial Innovation → The emergence of Bitcoin has catalyzed a wave of financial innovation, giving rise to a plethora of cryptocurrencies, blockchain-based applications, and decentralized finance (DeFi) projects.

While Bitcoin has achieved remarkable success, it still faces various challenges, such as scalability, energy consumption, regulatory scrutiny, and adoption hurdles. As the technology continues to evolve, these challenges are likely to be addressed or mitigated.

Conclusion:

Bitcoin represents a groundbreaking achievement in the realm of digital currencies. Its decentralized nature, limited supply, and transformative impact on finance make it a significant player in the ongoing evolution of money and technology.

However, as with any disruptive innovation, the future of Bitcoin remains uncertain, and its success will depend on its ability to adapt and address the challenges it faces. Nevertheless, its profound influence on the world of finance and technology is undeniable, and it continues to pave the way for a decentralized, borderless, and transparent financial future.