The 4-Year Crypto Cycle Explained in Just 2 Minutes

Understand the Market Cycles

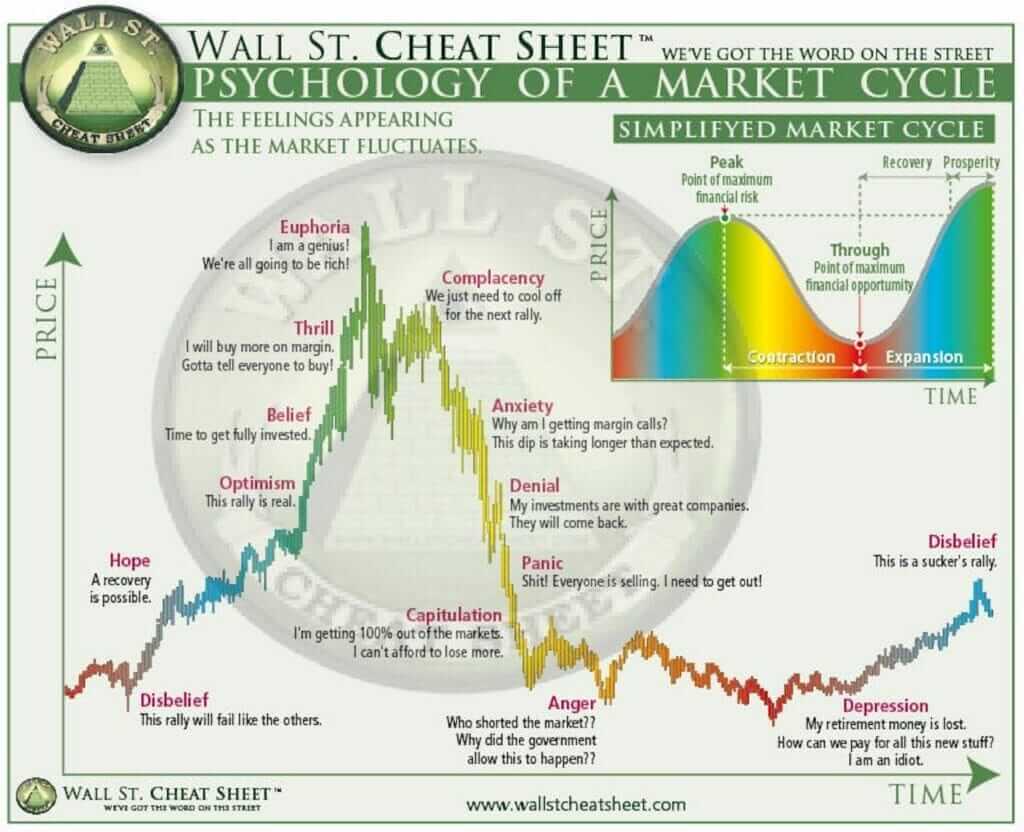

The concept of the 4 year crypto cycle is a widely observed pattern in the cryptocurrency market, particularly in relation to Bitcoin. This cycle plays a significant role in the market's price movements and can offer valuable insights for investors.

The Halving Event

At the heart of the 4 year cycle is Bitcoin’s “halving" event, which occurs approximately every four years. During a halving, the reward for mining new Bitcoin blocks is cut in half, reducing the rate at which new Bitcoin is generated. This event historically creates scarcity, often leading to a price increase.

The phrase “This time is different" is commonly heard in the crypto world. Usually, it’s not so different, but this cycle was indeed unique compared to previous ones. The Bitcoin pump began well before the halving, largely due to a new factor in this cycle: Bitcoin ETFs. Institutional money flooded the market, pushing Bitcoin to a new all-time high (ATH) even before the halving occurred.

The Bull Run

Following a halving, the market typically enters a bull run, characterized by a crazy surge in prices. This phase is driven by the reduced supply of new Bitcoin, coupled with media hype around the rising prices. Investors—both institutional and retail—flood the market, pushing prices to new highs. Historically, this bull run phase lasts about a year, fueled by the excitement and anticipation of continued gains. Unfortunately or luckily, we haven’t seen a bull market yet.

The Correction

After the bull market, the cycle usually enters a correction phase, where prices drop significantly from their peaks. This phase can be sharp and quick, with the market correcting by 30-50% or more. This period is crucial as it often shakes out speculators who entered the market during the hype. Remember 2018 or 2022? 👀

The Accumulation Phase

The final phase of the cycle is the accumulation phase, where prices stabilize at lower levels, and the market enters a period of relative calm. During this time, long-term investors and institutions often accumulate assets at a discount, preparing for the next cycle. This phase can last for one to two years before the next halving event restarts the cycle. Again, this time was different, and after the correction, we haven’t seen a very long accumulation phase, due to the optimism generated by the introduction of Bitcoin ETFs.

Conclusion

Understanding the 4 year crypto cycle can provide valuable insights into market behavior, helping investors make informed decisions. By recognizing the phases of the cycle (halving, bull run, correction, and accumulation), investors can better navigate the volatile crypto market.

This cycle, while not guaranteed, has repeated multiple times since Bitcoin's inception, making it a key framework for many in the crypto space.

Did you find this newsletter useful? Stay tuned, next time we will talk about the crypto seasonality in a bull run.